DNY59

I last updated unitholders in NextEra Energy Partners, LP (NYSE:NEP) to be cautious about catching the falling knife in late September 2023, following the disastrous downward revisions in its forward distribution guidance. I stressed that significant pessimism was likely reflected in its collapse. However, I also urged “investors to allow the selling fervor to reach exhaustion first.”

I’m pleased to highlight that I assessed NEP as having reached selling exhaustion in October 2023. A steep pullback in November followed as holders likely took profits as NextEra Energy Partners raised its payout by an annualized 6% QoQ to $0.8675 per unit, paid on November 14. These sellers likely anticipate that NEP could have difficulty sustaining its distribution growth, having taken a significant hit from its collapse.

However, NEP dip-buyers didn’t allow the selling fervor to break below its October low of $20, underpinning my thesis that NEP’s worst selling intensity is likely over.

Accordingly, NEP has recovered remarkably from its malaise, up more than 30% (in price-performance terms) from its October bottom. As a result, I gleaned that improved buying sentiments on NEP could lift the confidence of buyers still waiting on the sidelines as they assess the company’s growth prospects.

Seeking Alpha Quant’s “A+” valuation grade suggests it’s still priced attractively, notwithstanding its recent recovery off its October lows. Bearish investors would likely point out that the “bear market rally” isn’t sustainable, as high interest rates and NextEra Energy Partners’ high payout ratios could put it under more pressure to even deliver its lowered distribution growth outlook of 6% annually (below midpoint guidance of 6.5%) through 2026.

Despite that, I believe the LP’s decision to raise its Q3 distribution indicates its confidence in its execution to de-risk its portfolio to meet its growth guidance. Furthermore, the company’s recent agreement to sell its south Texas natural gas pipeline to Kinder Morgan (KMI) for $1.815B should corroborate NEP’s commitment to de-risk its balance sheet further and not issue dilutive equity to meet its convertible equity portfolio financings through 2026.

The recent $750M private offering of “7.25% senior unsecured notes due in 2029” could worry investors as it is earmarked for paying off cheaper 4.25% senior notes due in 2024. However, the context is essential, as NEP had already downgraded its distribution growth profile, likely considering such risks in its outlook. As a result, while the market is still placing NEP in the penalty box with the possibility of a distribution cut, its forward yield of 12.6% is still highly appealing, even if a possible cut could follow.

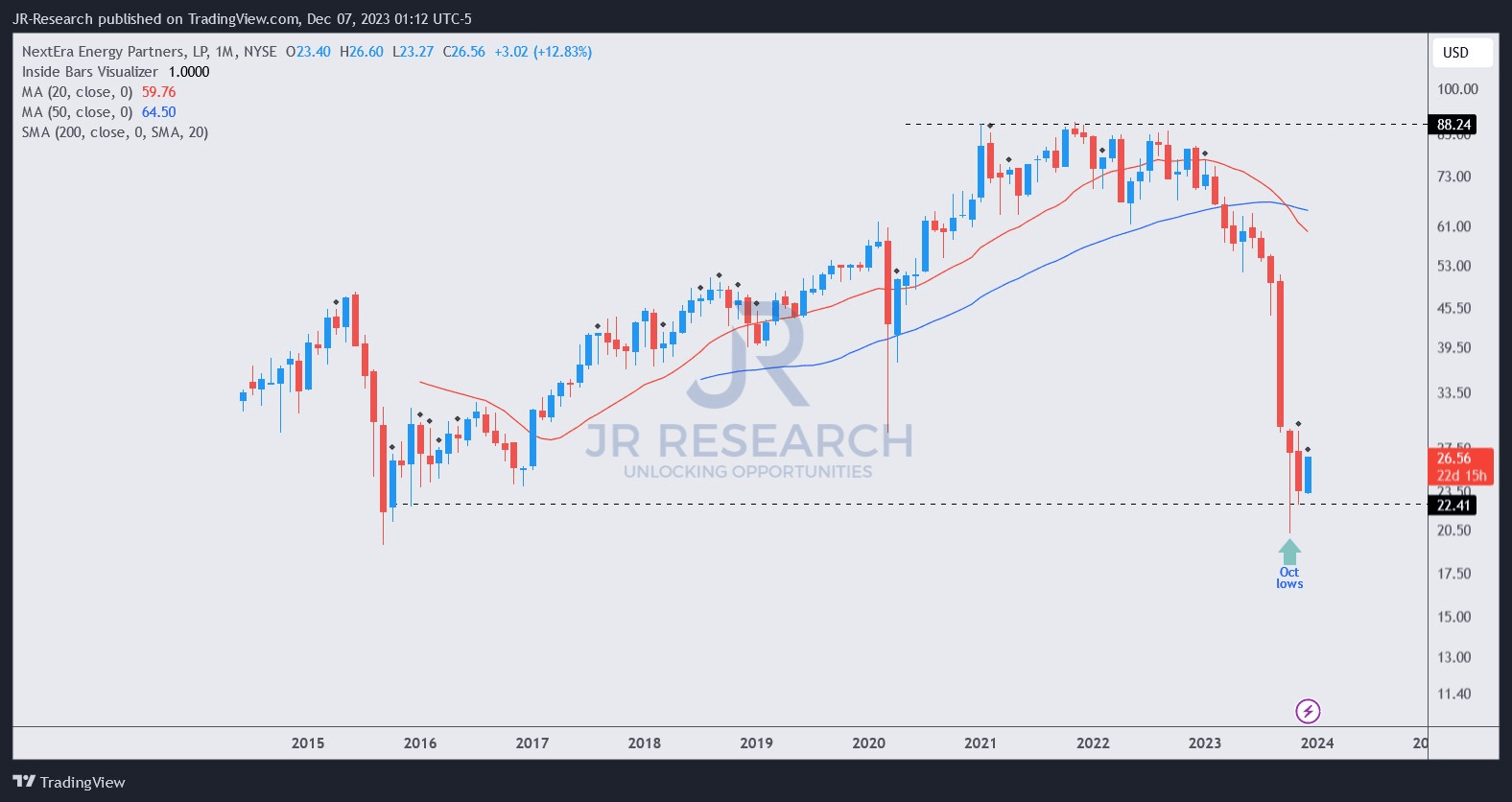

NEP price chart (monthly) (TradingView)

NEP’s long-term price chart shows signs of capitulation at its October 2023 low, justifying a more bullish tilt as it bottomed out. However, I wanted to be more cautious about ascertaining selling exhaustion before returning with a more constructive outlook.

The lack of sustained selling pressure to invalidate NEP’s October lows in November as it paid out the units bolstered my conviction that the low could hold. This month’s positive price action has lifted my conviction further, with NEP buyers continuing to hold above the critical $22.5 support zone, which is likely NEP’s long-term support level.

I expect NextEra Energy Partners to continue to be in the penalty box for the next half a year as the market assesses the improvement in its operating performance. However, astute investors should be aware that the market is forward-looking. Given the improvement in macroeconomic conditions (falling inflation, interest rates peaking, no apparent signs of a hard landing), I believe NEP’s recovery thesis is getting stronger. If we wait for the LP to show clear signs of recovery first, NEP might no longer trade at such attractive levels by then (repeat: the market is forward-looking).

Coupled with robust price action over the past two months justifying a sustained bottom, I’m ready to turn bullish on NEP at the current levels.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!