Robert Way

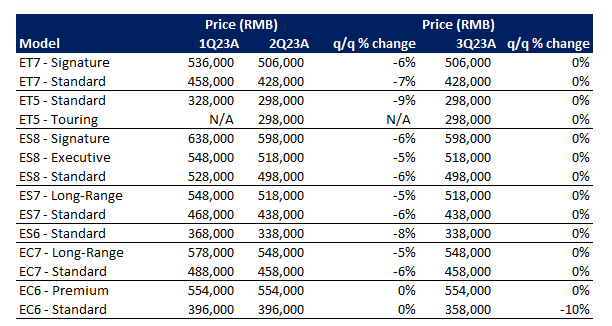

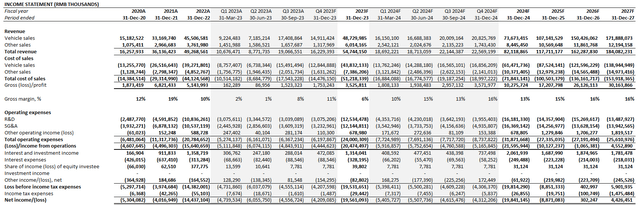

NIO’s stock (NYSE:NIO) has continued to find support in the $7 range, despite ongoing revenue underperformance during Q3 and a disappointing Q4 delivery forecast that effectively sent its 250,000-vehicle target set in the beginning of the year out of reach. However, vehicle gross margin expansion was a bright spot during the latest earnings release. The metric jumped from mid-single digits in the preceding three quarters due to the impact of an industry price war to 11% in Q3, as NIO’s vehicle slate completes its transition to the latest NT 2.0 platform, while the ongoing implementation of cost reduction initiatives continue to benefit its bottom-line.

While we expect the stock’s near-term gains to keep trailing behind the substantial gains observed at is Chinese EV peers over the past year, NIO is likely to find sustained support at $7 as its forward business roadmap underscores continued realization of margin expansion opportunities. This will be critical to offsetting near-term headwinds facing delivery volumes (e.g. macro-driven weakness in the demand environment and intensifying industry competition) and ensuing revenue growth.

Industrywide and Company-Specific Tailwinds to Vehicle Gross Margins

NIO’s latest earnings call has outlined a series of cost advantages realizable through its forward business roadmap that would be supportive of further improvements to its vehicle gross margins. In addition to recent industry-wide tailwinds stemming from the moderation of lithium prices from eyewatering levels observed last year, NIO has also demonstrated a slate of impending company-specific tailwinds to restoring its vehicle gross margins back towards the 20%+ range observed in 2021:

Tumbling Lithium Prices

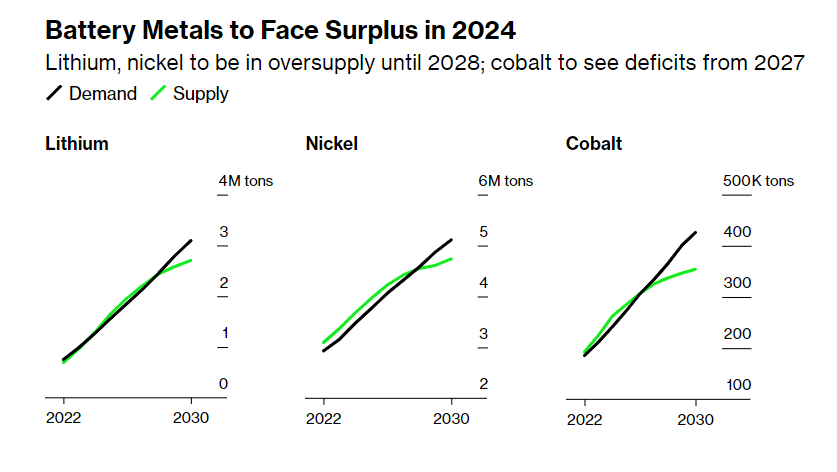

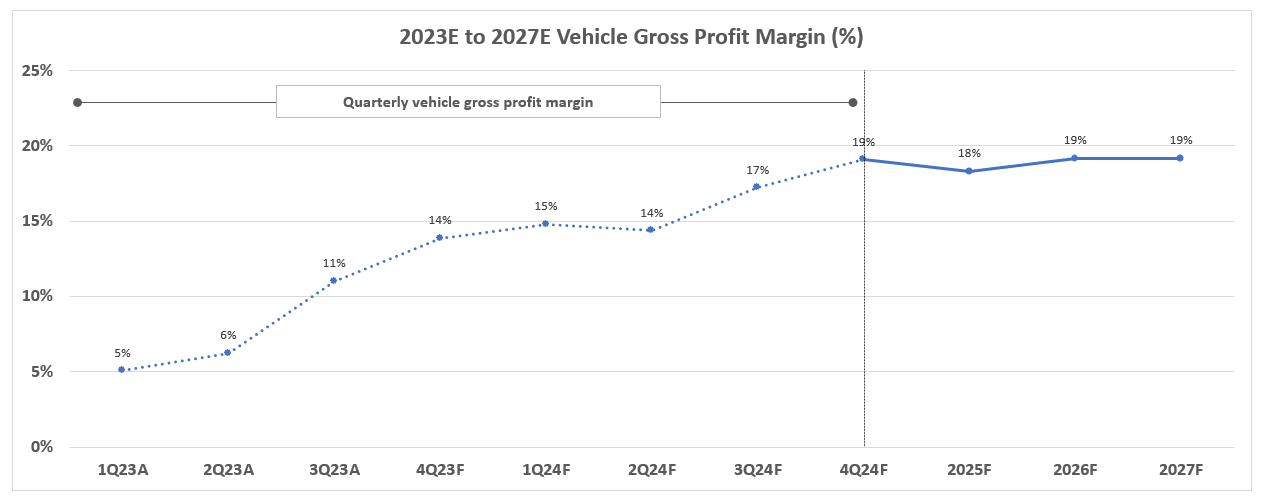

Prices of key raw materials for EV batteries have plummeted this year due to the combination of emerging new supply and a dampening global consumer demand environment for EVs. Specifically, lithium prices have declined by close to 70% this year, while refined lithium carbonate used in EV batteries tumbled further by 77% over the same period, diverging from the rally to peak prices in 2022. Looking ahead, lithium carbonate prices are expected to reach as low as RMB 80,000 per metric ton next year, down another 30% from the current two-year low of about RMB 115,500 per metric ton.

This will be primarily driven by the influx of new supply in the coming year, as mining projects that began during the beginning of the EV boom in the early 2020s start to materialize. Global lithium supply is expected to see a 40% upsurge next year, which will be sufficient to produce more than 1.4 million tons of lithium carbonate. Meanwhile, China in particular is expected to increase domestic lithium carbonate supply by at least 40% over the next two years, highlighting the potential raw material pricing tailwind to NIO and its domestic EV manufacturing peers.

To put into perspective, about 60kg of lithium carbonate is used in producing a 75 kWh battery – the standard battery pack size incorporated in NIO vehicles. This accordingly translates to an equivalent of more than 23 million units of 75 kWh battery packs on 1.4 million tons of lithium carbonate supply, exceeding the anticipated global EV production and sales volumes for 2024. Current market forecasts expect the global lithium surplus to jump from 4% in the current year to 12% in 2024, with oversupply to persist through 2028.

Bloomberg News

The emerging trend is in line with NIO management’s recent allusion to “decreased battery costs per unit” and the “lower price of lithium carbonate” as key drivers to vehicle margin expansion observed during Q3. Battery cost reduction trends will also be core contributors to further increasing vehicle gross profits through 2024, supporting management’s guidance for the metric to jump from the current 11% to 15% in Q4 and 18% exiting the following year.

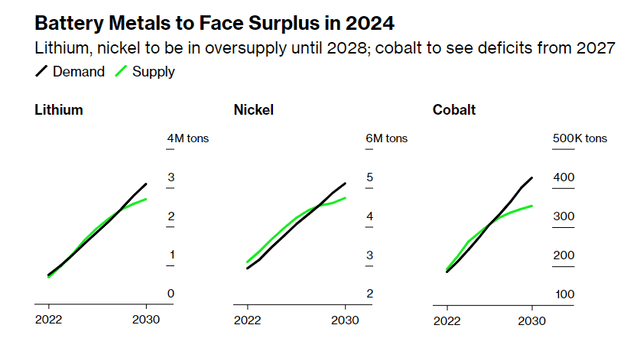

Stabilizing ASP

In addition to falling raw material and part costs, management has also cited stability in its vehicle average sale price (“ASP”) as a key factor to maintaining NIO’s pace of margin expansion going forward. Following price cuts of as much as 8% during the second quarter to better compete against an intensifying price war in the Chinese EV market, which took a heavy toll on its bottom-line, NIO has largely kept the MSRP of its vehicles unchanged during Q3. The all-new EC6 Coupe SUV based on the NT 2.0 platform, which started deliveries in September, was the only exception, with the MSRP on its standard trim dropping from RMB 396,000 to RMB 358,000 according to NIO’s website. Note that vehicle prices are about RMB 70,000 lower from the listing MSRP on average for purchase options without the battery in exchange for BaaS subscription instead.

Prices tracked from nio.cn

Looking ahead, NIO has committed to refraining from pushing volumes at the expense of vehicle margins through further price reductions, despite intensifying industry competition. Instead, the company hopes to preserve its pace of vehicle margin expansion observed during the third quarter, while also driving benefits to NIO’s “brand image and product competitiveness” by maintaining a stable vehicle ASP going forward.

In order to compensate for its seeming lack of pricing competition to peers, NIO has stepped up on its sales efforts by aggressively expanding relevant headcount during the third quarter. Specifically, NIO has added about 3,300 sales personnel in September and October, taking the revenue-generating team’s headcount to 5,700. The expanded sales capacity will be key to driving NIO brand awareness amongst existing and prospective buyers, while also deepening market share penetration beyond its core markets across Shanghai, Jiangsu Province, and Zhejiang Province.

While this strategy could potentially translate into higher sales costs in the near-term, we expect NIO’s recent cut of as much as 10% of its workforce implemented in November to be a key compensating factor. Specifically, the reduction of roles and positions that are not expected to yield “any financial contribution in the coming three years” is expected to free up resources for reallocation towards areas like sales capacity expansion, which is critical to pushing revenue growth and margin expansion over the longer-term. The shift in NIO’s workforce composition is expected to drive a net benefit of RMB 2 billion in annualized payroll savings beginning 2024. Paired with stabilization in its pricing strategy, NIO is expected to realize a further impact from improving economies of scale as its NT 2.0 vehicle line-up continues to ramp.

Manufacturing Efficiencies

With the transition of NIO’s vehicle line-up to the latest NT 2.0 platform now largely complete, the ensuing ramp of productions will be key to scaling relevant costs. However, management expects to realize incremental improvements to the vehicle manufacturing process and NT 2.0 product cost structure going forward by further “optimizing design, improving supply chain and production efficiency”, and engaging in negotiations with key business partners and vendors. The strategy also includes the impending internalization of vehicle manufacturing in-house, which effectively rids NIO of its former asset-light vehicle production strategy realized through its partnership with Anhui Jianghuai Automobile Group (“JAC”).

Recall from our previous coverage on NIO that JAC – a state-owned automobile manufacturer in China – has been NIO’s sole manufacturing partner since the start of production (“SOP”) in 2018. NIO also has proceeded to form a joint venture with JAC with a 49% stake in the arrangement. In the latest development, NIO is expected to acquire some of JAC’s manufacturing assets and equipment for RMB 3.2 billion and internalize the entire vehicle production process after receiving government approval to build cars independently. And management expects ultimate reductions of as much as 10% to vehicle manufacturing costs via the internalized production strategy, realized through its tailored production line designs and proprietary manufacturing technologies. While there have been limited details to when said plans would materialize, we expect in-house production of NIO’s line-up to begin in 2H24 when its current joint venture partnership with JAC ends in May 2024, which also coincides with the planned SOP and go-to-market (“GTM”) timeline for its upcoming ALPS mass market sub-brand.

In addition to manufacturing efficiencies realized through ongoing platform design changes, and the impending internalization of the process, management has also implemented a project optimization plan that warrants the termination of undertakings not expected to yield financial results within three years. This includes shelving plans announced earlier this year on internalizing its battery production process, which is not expected to start production until 2025 and implies incremental pressure on profitability until later in the decade.

In the latest development, management has announced the deferral of such plans, and resorting to the in-house “R&D of battery cells, battery materials, and battery packs” only going forward in order to optimize the company’s path to profitability. The announcement is complemented by recent speculations of an impending spin-off of NIO’s battery manufacturing unit before the end of 2023, which could further alleviate pressure from the company’s profit trajectory.

ALPS Go-To-Market

We believe the biggest cost driver and operating leverage enabler over the near- to mid-term will be the SOP and subsequent GTM of NIO’s ALPS mass market sub-brand. The ALPS brand is expected to be NIO’s answer to the mass market, which management had previously alluded to as key to competing in the price segment of Tesla’s (TSLA) best-selling Model 3/Y, while providing “much better service”. This is in line with management’s plans to offer shared “service capacities and facilities” between ALPS and the premium NIO brand, underscoring convenient and reliable access to quality maintenance capabilities to prospective ALPS vehicle owners.

However, given the ALPS sub-brand is catered to the mass market pricing segment, its vehicle line-up is expected to be an impending headwind to NIO’s consolidated ASP. NIO’s vehicle ASP registered in Q3 was about RMB 314,000, and is expected to decline further in 2H24 when ALPS deliveries begin given the sub-RMB 300,000 pricing segment that the sub-brand seeks to gain market share in. When NIO’s vehicle ASP first fell through the RMB 300,000 market in Q1, its bottom-line took a significant hit with vehicle gross margins falling to 5%. This continues to underscore the importance of margin expansion efforts noted in the foregoing analysis to offset the impending reallocation of sales mix to lower-priced mass market ALPS products in the longer-term.

In addition, the anticipated SOP and GTM of ALPS models in 2H24 is likely to result in temporary incremental ramp-up costs. However, we expect this headwind to be potentially offset by improved economies of scale realized on larger production volumes, given the ALPS models are also based on the NT 2.0 platform. Incremental cost-savings stemming from the anticipated internalization of vehicle manufacturing could also help to absorb some of the related cost headwinds pertaining to ALPS SOP and GTM over the longer-term.

Vehicle Gross Margin Forecast

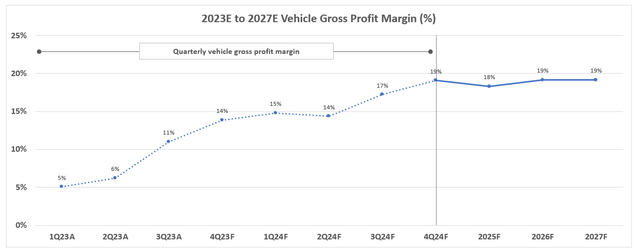

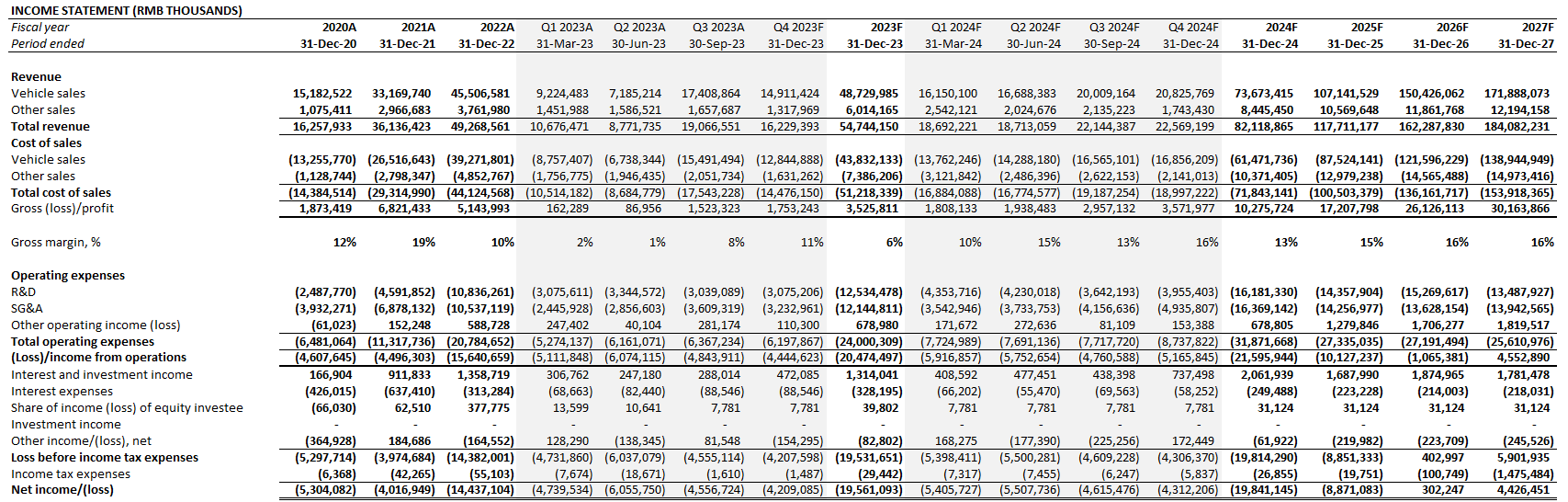

Taken together, we expect vehicle gross margin of 10% for full year 2023, as continued cost improvements through 2H23 are expected to offset the impact of vehicle pricing challenges observed in 1H23. The improvements are expected to scale further through 2024, which will be crucial to offsetting some of the ramp-up cost headwinds pertaining to the initial deliveries of ALPS models in 2H24, and support management’s guide for 18% vehicle gross margin exiting next year. And over the longer-term, we expect NIO’s vehicle gross margins to gradually recover back towards 19% over the five-year forecast period, and stabilize in the low-20% range thereafter. This is expected to complement improving operating leverage as NIO and its impending sub-brand products continue to scale through improved penetration into mass market opportunities.

Author

Factors Supporting Operating Leverage

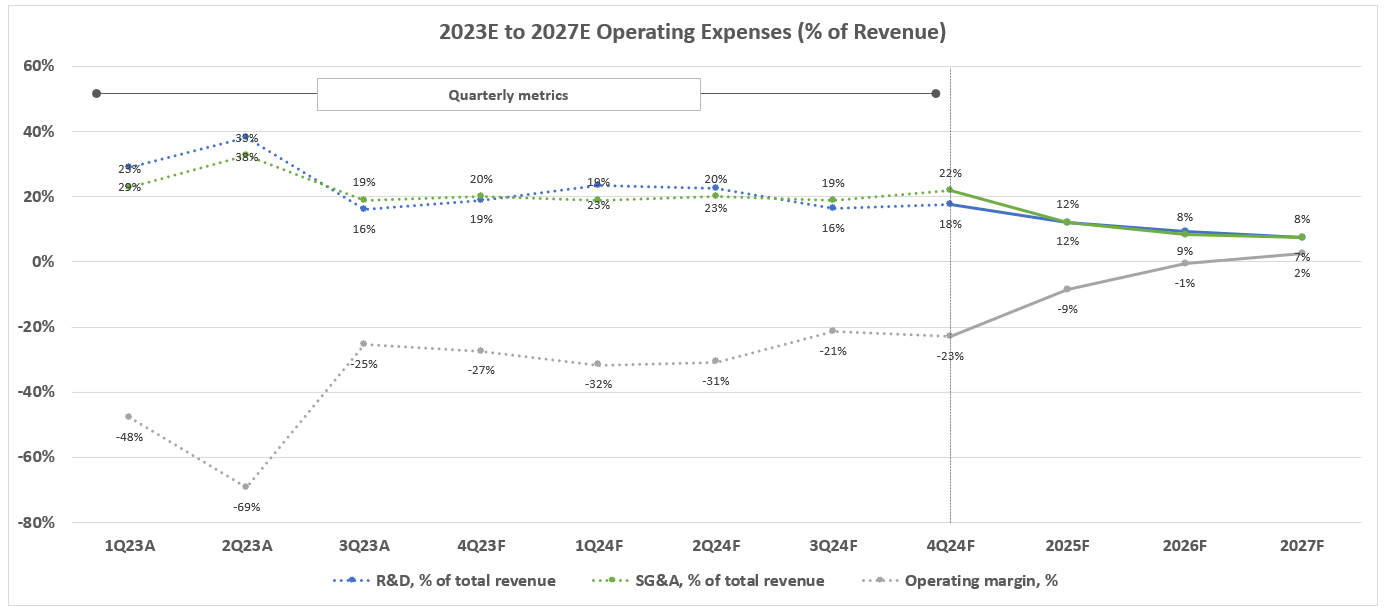

In addition to anticipated improvements to vehicle gross margins, NIO is also expected to start realizing improvements in operating leverage heading into the latter half of 2024.

This is in line with NIO’s stabilizing average quarterly R&D spend in the RMB 3 billion to RMB 3.5 billion range over the longer-term, as management cites the need to focus on core technology investments and new product launches – including the upcoming flagship model which will launch at the upcoming NIO Day event on December 23. We expect the stabilizing R&D costs to benefit from scale heading into 2024, as the completion of NIO’s transition of its vehicle line-up to the NT 2.0 platform is expected to reduce manufacturing disruptions going forward and contribute to the improved ramp-up of productions.

Meanwhile, SG&A expenses are expected to increase moderately over the near-term to account for the newly expanded sales team aimed at shoring up vehicle delivery volumes and offsetting the impact of stabilizing vehicle prices at NIO amid an intensifying price war and overall industry competition. We expect some of this expanded sales capacity will be attributable to the upcoming GTM of ALPS, as management expects the new hires in September/October to start generating value in six months’ time. As a result, we expect annualized SG&A expenses to normalize in the RMB 13 billion range, and start scaling towards a lower percentage of revenue beginning mid-decade when Firefly – the second of NIO’s currently planned sub-brands for mass market penetration – goes to market.

There will also be incremental improvements to operating leverage exiting 2024 when vehicle production volumes increase with SOP of ALPS models, which are also based on the NT 2.0 platform. As discussed in the earlier section, ALPS will also be sharing its service facilities with NIO, thus improving the overall economies of scale realizable across consolidated operations.

Author

Taken together, we expect nominal GAAP-based net income at NIO exiting 2026.

Author

NIO_-_Forecasted_Financial_Information.pdf

Salvaging Sales Growth

Aside from cost reductions, maintaining a resilient trajectory of growth will also be critical to NIO’s forward profitability prospects. Despite its commitment to stabilizing its pricing strategy amid intensifying competition, NIO also faces the challenge of ongoing economic deterioration in China.

While Chinese EV sales have continued to forge new monthly record highs, they have been growing at a decelerating clip. Even with subsidies and tax rebates offered by some local municipalities on eligible EV purchases to compensate for the central government subsidy scheme that ended last year, demand has dampened on big-ticket purchases as consumers continue to reel from the wealth-declining impact stemming from China’s ongoing property slump and weakening labour market.

Although NIO’s premium products cater to a more affluent customer base, its market share across major economies within China is also starting to consolidate. The company has disclosed that about half of its market share is currently saturated from Shanghai, Jiangsu Province, and Zhejiang Province, which are tier-1 economic regions in China. This is in line with our previous observations that the mass market’s higher price sensitivity has been a major roadblock for NIO in expanding market share. Management has also cited the lack of supporting EV infrastructure in lower-tier economies within China as an existing barrier to sales.

As a result, we believe NIO’s continued build-out of its NIO POWER capacities – which includes charging and battery swap stations – as well as the upcoming introduction of the lower-priced ALPS sub-brand will be key to increasing its brand awareness and improving its penetration into mass market opportunities. This would also alleviate market share consolidation in top tier economies within China over the longer-term.

On a net basis, we expect reacceleration in NIO’s delivery volumes through 2024 and 2025 with the GTM of NIO’s ALPS and Firefly mass market sub-brands. Meanwhile, the flagship premium NIO brand is likely to start seeing a moderating pace of growth, offset by a greater mix of higher-priced SUV sales, going forward due to market share consolidation and intensifying competition across majority economies within China.

Author

Valuation Considerations

Author

Based on the foregoing analysis on NIO’s redirection of focus towards achieving profitability to compensate for ongoing underperformance in delivery volume growth, we are adjusting our base case price target for the stock to $8. The price target is derived from the discounted cash flow approach, which considers projections taken in conjunction with our updated fundamental forecast for NIO as discussed in the earlier section. The analysis applies a 9% WACC in line with NIO’s capital structure and risk profile, as well as an implied perpetual growth rate of 3.5% in line with China’s projected pace of economic expansion to represent the company’s normalized growth prospects.

Author

Author

Recent reports of a potential spin-off of NIO’s battery production unit currently in the works also represents an imminent opportunity for incremental value creation. NIO currently relies on Chinese battery maker Contemporary Amperex Technology Co., Limited (“CATL”), and will likely continue to do so after shelving the plans announced earlier this year on bringing production in-house. As mentioned in the earlier section, the originally planned in-house battery production facility in Anhui province had its SOP timeline scheduled for 2025. This essentially translates to incremental ramp-up costs thereafter, which do not align with management’s newly set investment criteria for current projects to start yielding positive contributions to profitability within three years. Hence the potential spin-off of the battery manufacturing unit would be supportive of NIO’s redirected focus towards turning a profit and reinvesting into other areas of high-returning growth, which is inadvertently value accretive to the stock from current levels.

The Bottom Line

We believe NIO’s range-bound trading at the $7-level reflects market anticipation for a moderated pace of growth from its flagship premium line-up, offset by improving vehicle margins over the near-term. Looking ahead, we expect several tailwinds, including margin expansion from commodity pricing trends and company-specific spending optimization efforts, volume growth and market share gains reinforced by the impending launch of ALPS, as well as ensuing improvements to operating leverage realized through economies of scale. These remain key near-term value accretive factors to the stock, with consistent positive fundamental improvements to the underlying business going forward being key to restoring investor confidence.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.