Harald Schmidt

Investment Thesis

Mondelez International (NASDAQ:MDLZ) has good revenue and margin growth prospects ahead. The company’s revenue growth should benefit from the carryover impact of price increases taken over 2023 and incremental price increases planned for the coming year. Moreover, the company’s end-market demand is healthy, thanks to resiliency among consumers for snacking products despite the economic downturn. This should help the company sustain volume growth momentum and deliver healthy revenue growth. In addition, product innovations and accretive M&As should also support the revenue growth of the company.

On the margin front, the company should be able to deliver margin growth with the help of benefits from price increases, moderating inflation, volume leverage, improving efficiency, and accelerating cost synergies. Furthermore, the company offers a good forward dividend yield of 2.41%, and the valuation based on the forward P/E multiple is trading below historical averages. The reasonable valuation along with good growth prospects makes the company a buy at the current stock price.

Revenue Analysis and Outlook

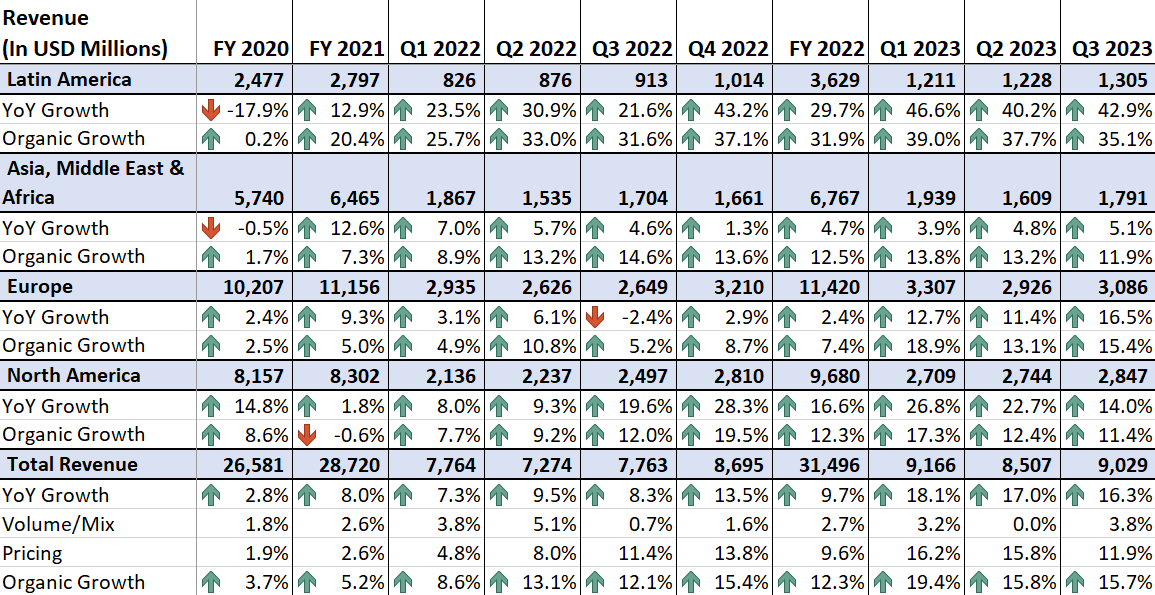

Mondelez’s revenue growth was impacted during the initial phase of the pandemic due to mobility restrictions. However, the sales growth quickly rebounded and the growth was further supported by price increases taken by the company to offset inflationary pressure. Despite increasing prices, volume growth has remained stable due to the resilient nature of demand for the company’s product categories.

In the third quarter of 2023, the company’s revenue growth momentum continued. Revenue growth benefited from price increases and favorable contributions from volume/mix. In addition, the company also benefited from its 2H22 acquisitions of Ricolino and Clif Bar. This resulted in a 16.3% YoY increase in revenue to $9.02 billion. Excluding the negative impact of 2.2 percentage points from foreign exchange and benefits of 2.8 percentage points from the acquisition, organic sales increased by 15.7% YoY. The organic sales growth reflected a 3.8 percentage point benefit from favorable volume/mix and an 11.9 percentage point benefit from price increases.

MDLZ’s Historical sales (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to continue delivering sales growth as it continues to benefit from price increases, good end-market demand, product innovations, and M&A.

Over the past year Mondelez, like the rest of the industry, increased prices for its products to protect its margins from inflationary headwinds. This helped the company’s sales growth. The company has been taking pricing actions over the last few quarters across all of its geographies (more meaningful in some geographies than others) and plans to further take price increases in the coming year as well. So, I expect the carryover impact of previous price increases and incremental pricing moving ahead should continue to help the company’s sales growth.

Mondelez’s product portfolio tends to be non-cyclical and does not have a material impact from unfavorable macroeconomic conditions. Over the past year, despite meaningful increases in product prices, the company’s volume levels remained stable, thanks to good demand for snacking products despite a challenging macroeconomic environment. This is because snacking products like chocolate, biscuits, and baked goods are often considered affordable indulgences, and continue to enjoy popularity among consumers even during economic downturns.

The resilience in demand can be attributed to the comfort associated with these snacks, which serve as small, affordable luxuries during tough times. The relatively low price point of many snacking products makes them accessible even when budgets are tight. Additionally, the convenience factor of grab-and-go snacks makes them a preferred choice for busy lifestyles. While there might be some shifts in purchasing patterns (smaller packs, preferences for discounted items, or fewer visits to the store), the strength in demand for these familiar and comforting snacks showcases their resilience even during tough macroeconomic conditions. So, I expect volume levels to sustain their growth momentum in the coming year due to healthy end-market demand for the product category.

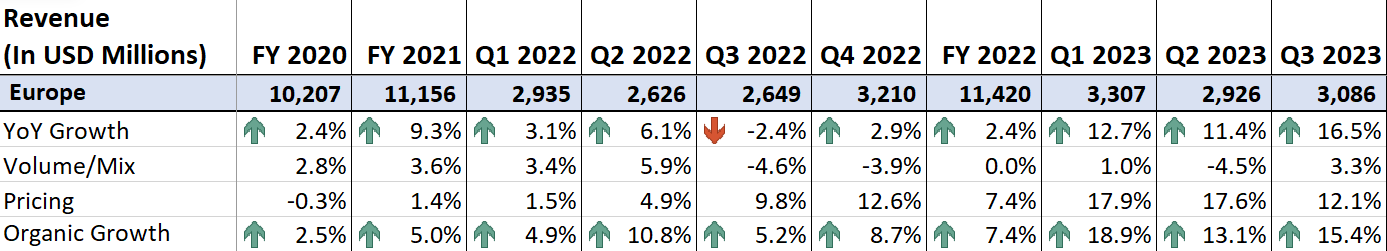

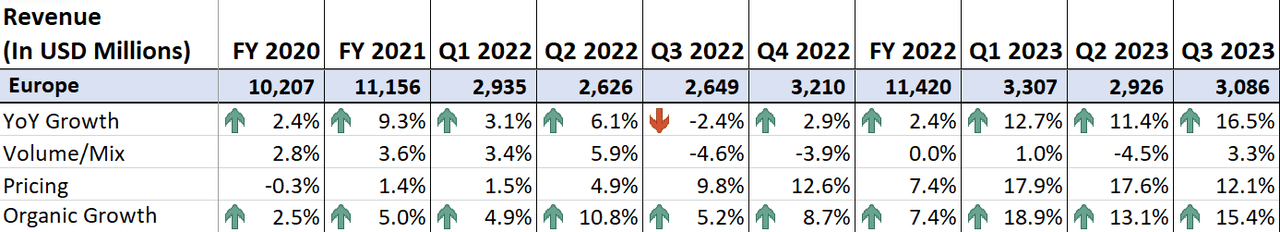

Coming to strength in demand across geographies, volume levels and demand have remained healthy across geographies, except Europe, where volume growth was affected by disruption driven by retailer-price negotiation in the region over the last year.

MDLZ’s Europe Segments Historical sales Analysis (Company Data, GS Analytics Research)

However, according to management, the price increases in Europe have been implemented and all negotiations are completed, implying no further disruption should impact volume growth in the region moving forward. This along with easy volume comps should help the volume growth recovery in Europe, making it join the rest of the geographies in delivering healthy volume growth.

Furthermore, the company is also focused on continuously innovating its product portfolio according to changing consumer preferences. MDLZ is expanding its products in the healthy snacking category. The nutritional snacking category is picking good demand after COVID-19 as health concerns increased among people. In the first half of 2023, MDLZ launched its first under-100-calorie Cadbury treat for adults. In addition, the company is also increasing its offering in a broader range of portion-controlled packs and products. This should also help in boosting demand for the company’s product portfolio and support sales growth.

Lastly, the company has a good track record of growing sales inorganically through small strategic tuck-in acquisitions. In 2022, the company acquired Chipita (January 2022), Cliff Bar (August 2022), and Ricolino (November 2022). These acquisitions helped the company in delivering good inorganic sales growth over the 2022 and 2023. Management plans to continue to remain active in the M&A market for potential acquisitions in 2024, and the company’s healthy balance sheet with an expected leverage ratio in the mid-to upper 2s range by the end of FY23, should also support inorganic growth.

Overall, I remain optimistic about the company’s revenue growth prospects in the coming year.

Margin Analysis and Outlook

The company’s margins faced pressure from inflationary raw material costs and supply chain constraints in late FY21 and FY22. However, over the past couple of quarters, the company has been able to offset these headwinds with the help of price increases, and volume leverage. Moreover, supply chain constraints have also eased, helping lowering manufacturing costs. This also supported margin growth in the third quarter. As a result, in the last quarter, the company’s adjusted gross profit margin increased by 120 bps YoY to 38.6%, and the adjusted operating margin increased by 60 bps YoY to 16.7%.

MDLZ’s Historical Adjusted Gross Margin and Adjusted Operating Margin (Company Data, GS Analytics Research)

Looking forward, I believe the company’s margin should continue to increase. Over the last year, Mondelez has experienced moderation in the inflationary cost of the majority of its commodity basket like dairy, wheat, edible oils, sugar, and nuts. Cocoa is the only major raw material of the company that has continued to see a price increase. However, with the help of benefits from the carryover impact of prices along with incremental price increases moving forward, I expect the company to more than offset it.

Moreover, as supply chain challenges have now eased and are expected to abate in the coming year, manufacturing costs should decrease further. This creates a favorable cost environment for the company’s margin growth moving ahead.

Furthermore, I expect margins to also benefit from volume leverage and the company’s investment in productivity tools. In the second quarter of 2023, the company appointed dedicated Revenue Growth Management (RGM) leadership and teams in all key markets. These teams are supported with new proprietary data and analytics assessments, digital tools, and a comprehensive training program. This should help the company in increasing productivity and efficiency in operations, supporting margin growth. Lastly, the company’s margin should also benefit from cost synergies from the Cliff Bar acquisition (acquired in November 2022). Management expects the benefits of cost synergies to accelerate in FY2024 as the acquisition completely integrates within Mondelez. This should also support margin growth in the coming year. Hence, I am optimistic about the company’s margin growth prospects ahead.

Valuation and Conclusion

The company is trading at 20.19x FY24 consensus EPS estimate of $3.50, which is below the historical 5-year average forward P/E of 21.22x. I believe the company has good growth prospects ahead benefiting from price increases, volume growth due to good end-market demand, product innovations, M&As, moderating inflation, and sales leverage. In addition to good revenue and margin growth prospects, the company also offers a forward dividend yield of 2.41%. This along with lower than historical average valuation provides a reasonable entry point at the current stock price. Hence, I have a buy rating on MDLZ stock.