Drew Angerer

NIO Inc. (NYSE:NIO) investors have had a miserable year as we close in on the last three weeks of 2023. NIO has significantly underperformed its pure-play EV peers in China over the past year, registering a total return of -42%. In contrast, investors in XPeng (XPEV) and BYD Company (OTCPK:BYDDF) have experienced much better relative performances, posting a total return of 43% and 9.4%, respectively, over the same period. Notwithstanding NIO’s supposed market leadership in the premium EV segment, the market remains concerned about whether NIO could face worse headwinds in 2024. I updated investors about my disappointment with its underperformance in my previous article. I stressed that management hasn’t proven to be a reliable partner with its investors, consistently underperforming its outlook. As a result, investors have likely lost confidence in management’s near-term ability to engineer an effective turnaround.

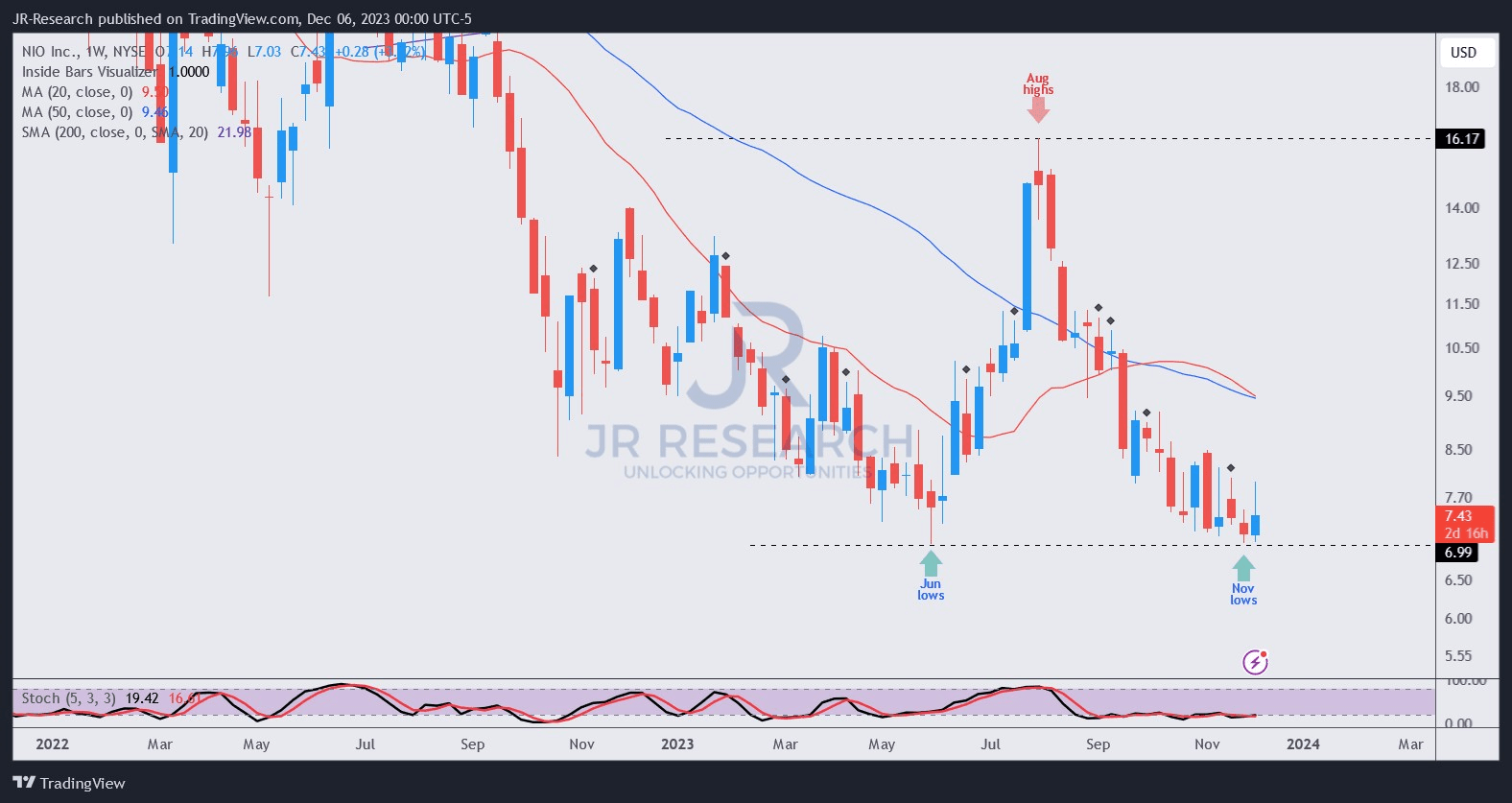

The company posted its third-quarter or FQ3 earnings release on December 5, which led to an initial post-earnings rally that fizzled out as trading closed. The lack of sustained buying sentiment was palpable as NIO continued its consolidation just above the $7 support level, which was first formed in early June 2023. As a result, I believe dip-buyers have attempted to bolster NIO’s recovery, anticipating a final bottoming before a further recovery in 2024. However, yesterday’s weak recovery has likely put further doubts to that thesis, although I gleaned that NIO’s worst selling intensity could be over.

Accordingly, NIO posted revenue growth of 47% YoY, following a solid quarter of deliveries of 55.43K vehicles. However, that metric isn’t unexpected, as NIO updated its deliveries through November 2023 last week. Noteworthy in NIO’s earnings release was the significant recovery in its total gross margin to 8%, well above its Q2 disaster of 1% gross margin. As a result, NIO investors considering adding exposure at the current levels must anticipate whether the demand/supply dynamics in its target market could help offset the increasingly competitive headwinds in China’s premium EV market.

Accordingly, management telegraphed the need to maintain “stable prices” even when dealing with “aggressive price reductions by established competitors like BMW and Mercedes.” As a result, it demonstrated that NIO has been able to scale more efficiently, bolstered by the collapse in battery-grade lithium carbonate prices this year.

The possibility of a further fall in lithium prices in 2024 shouldn’t be ruled out, underpinning NIO’s ability to gain traction in its gross margin improvement. The company is optimistic about its margin trajectory, expecting to achieve 15% in vehicle gross margin in Q4, up from Q3’s 11% metric. Notably, NIO targets a significant recovery in vehicle gross margin to between 15% and 18% for FY24. In an announcement yesterday, the company acquired manufacturing facilities from its manufacturing partner JAC for RMB 3.16B. Management is optimistic about furthering the collaboration with JAC, underscoring that “production activities continue as usual.” Still, NIO highlighted that the opportunity to internalize its manufacturing processes could improve its efficiencies further, leading to an expected 10% reduction in manufacturing costs over time.

NIO’s FQ4 outlook suggests a flat MoM improvement in vehicle deliveries, well below the 20K target that it set previously. Accordingly, management guided to about 48K deliveries at the midpoint of its Q4 guidance range. Based on its deliveries of 32K vehicles in October and November, it suggests a 0.9% MoM uptick for December at about 16K. Therefore, I believe the market would still place management in the penalty box, as it has not demonstrated its ability to outperform in 2023. As a result, investors must remain circumspect about management’s expectations, and it might be better to discount their outlook significantly.

NIO price chart (weekly) (TradingView)

Despite the near-term caution, I’ve gleaned another speculative opportunity for NIO investors to add exposure, as its $7 support zone seems to have held firmly.

I had expected a more robust reversal yesterday, but NIO’s price action suggests the buying momentum weakened at the close of yesterday’s trading. However, if NIO’s management could keep up with an improved 2024 production and deliveries roadmap, I believe the worst seems to be over, as much pessimism has likely been priced in, given NIO’s relative underperformance against its peers.

Rating: Upgraded to Speculative Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.