JamesBrey

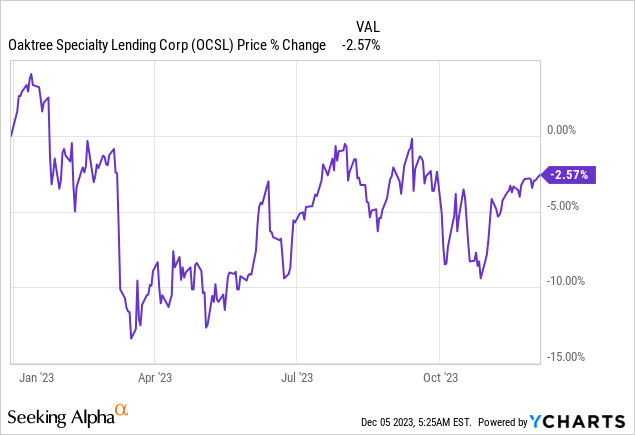

Oaktree Specialty Lending (NASDAQ:OCSL) is an Oaktree-backed BDC whose portfolio has materially improved in quality since the global asset manager took over management in 2017. Oaktree Specialty Lending has re-oriented itself and successfully employs a first lien strategy, which is one reason why I would recommend OCSL to dividend investors. Other reasons to include OCSL in an income-focused portfolio are that Oaktree Specialty Lending has ample liquidity and could be an opportunistic debt buyer in the next market crash, and the BDC’s dividend is well-supported by GAAP net investment income. I am happy to pay a premium to Oaktree Specialty’s 11% yield and continue to see a favorable risk profile for dividend investors!

Previous rating

I recommended Oaktree Specialty Lending in April 2021 – A 7.3% Yield And A Long-Term Buy After Merger – after the BDC completed its merger with Oaktree Strategic Income Corporation which resulted in a stronger and more diversified investment portfolio. Considering that Oaktree Specialty Lending is still a well-run BDC with good portfolio diversification, good dividend coverage, and an opportunistic investment approach during times of crisis, I confirm my OCSL buy rating for dividend investors.

Portfolio transformation and first lien strategy under Oaktree supervision

Oaktree Specialty Lending is a closed-end, externally managed BDC with a large portfolio consisting chiefly of debt investments. Within the category of debt investments, OCSL’s specialty is the investment in First liens.

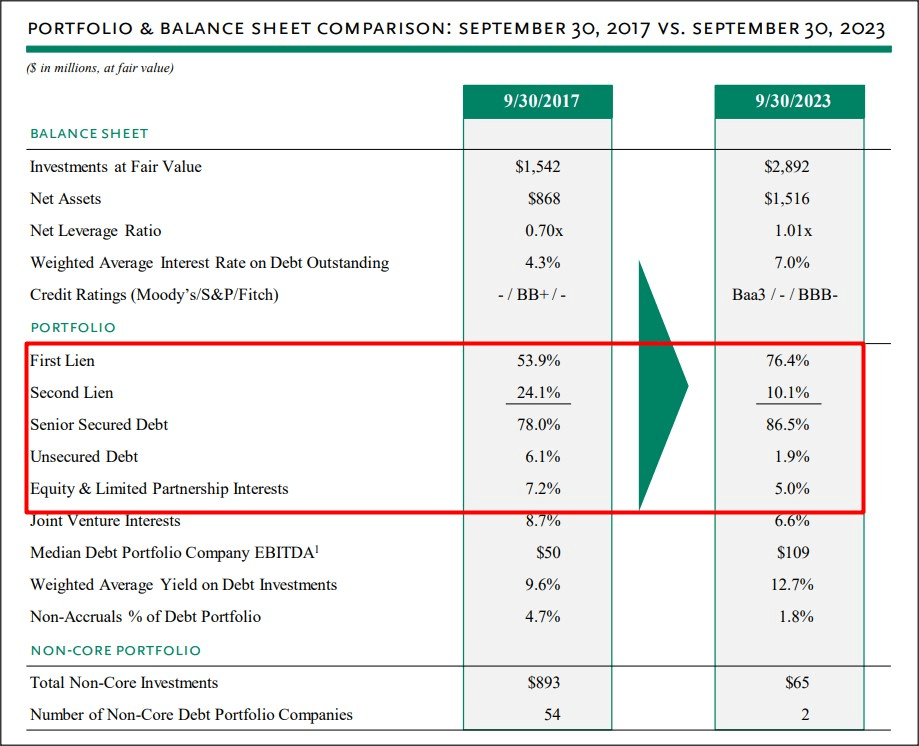

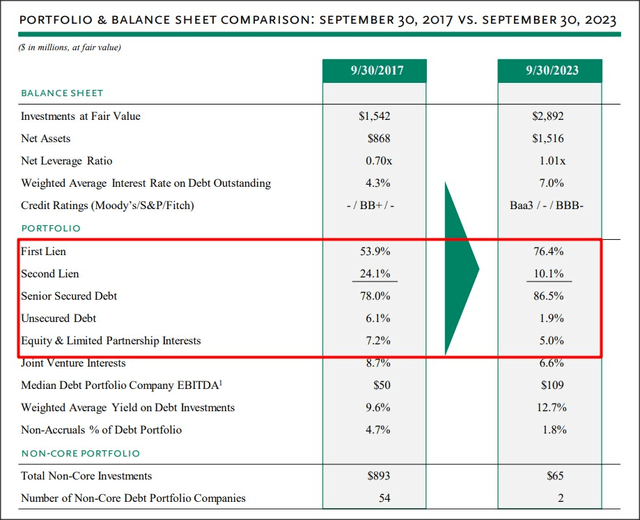

In the last six years, major changes have occurred on OCSL’s portfolio level. Oaktree Specialty Lending’s portfolio has drastically improved in quality since 2017 which is when global investment company Oaktree assumed management of what is now Oaktree Specialty Lending.

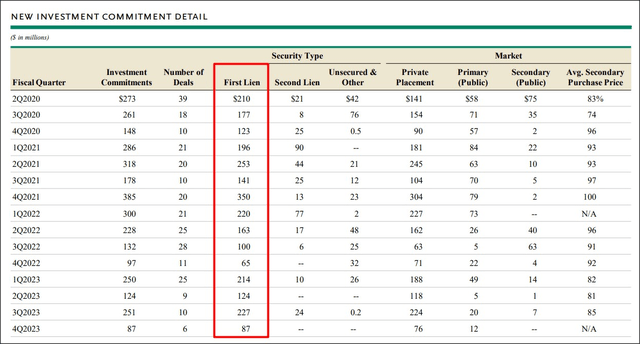

Since then, Oaktree’s management has driven a push toward better credit quality and less risk which stood in contrast to the more yield-driven approach taken by the prior manager. Oaktree Specialty Lending has focused more on safer investments with less risk which has served the BDC well: first liens had an investment share of 76.4% in the September quarter compared to 53.9% in Q3’17. At the same time that Oaktree pushed a first lien strategy, second liens and unsecured debt investments were greatly reduced with the largest investment reduction happening in the second lien group. Today, Oaktree Specialty Lending’s second liens and unsecured debt represent only 12% of investments compared to 30% in Q3’17.

Oaktree Specialty Lending

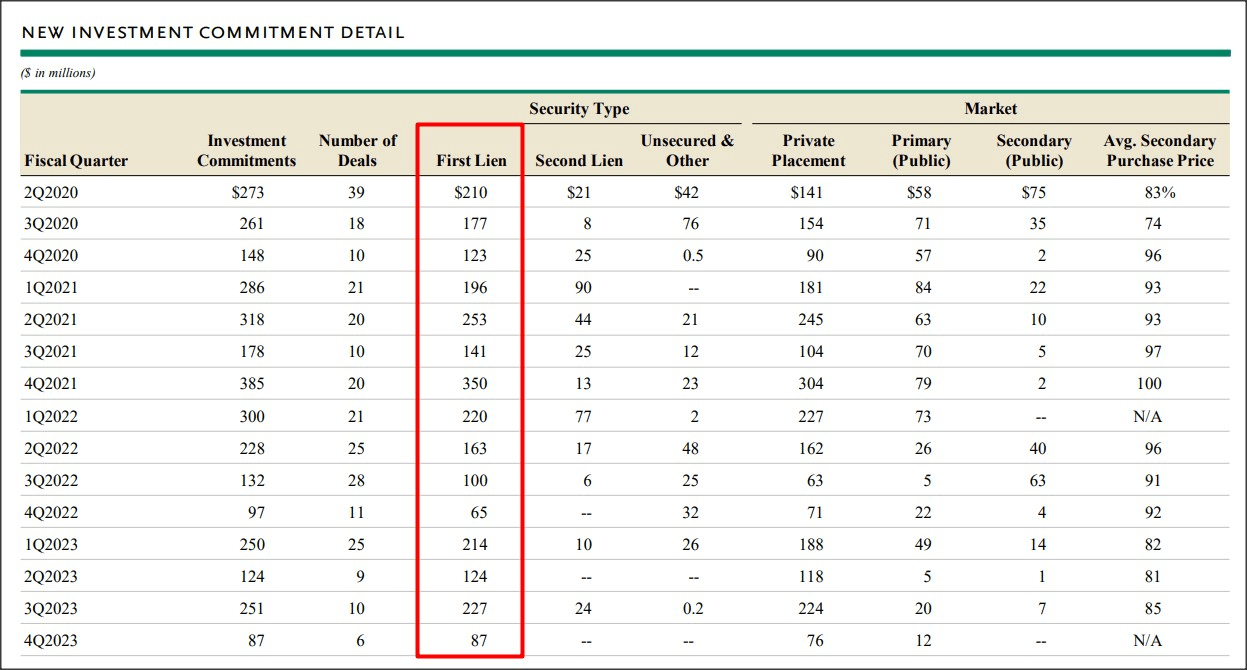

Because of the changing investment strategy within Oaktree Specialty Lending, the BDC has originated a lot more first liens in the last several years. Although Oaktree Specialty Lending pursues other originations in order to take advantage of yield opportunities in second liens and unsecured debt, the first lien strategy is what I like the most about the BDC.

Oaktree Specialty Lending

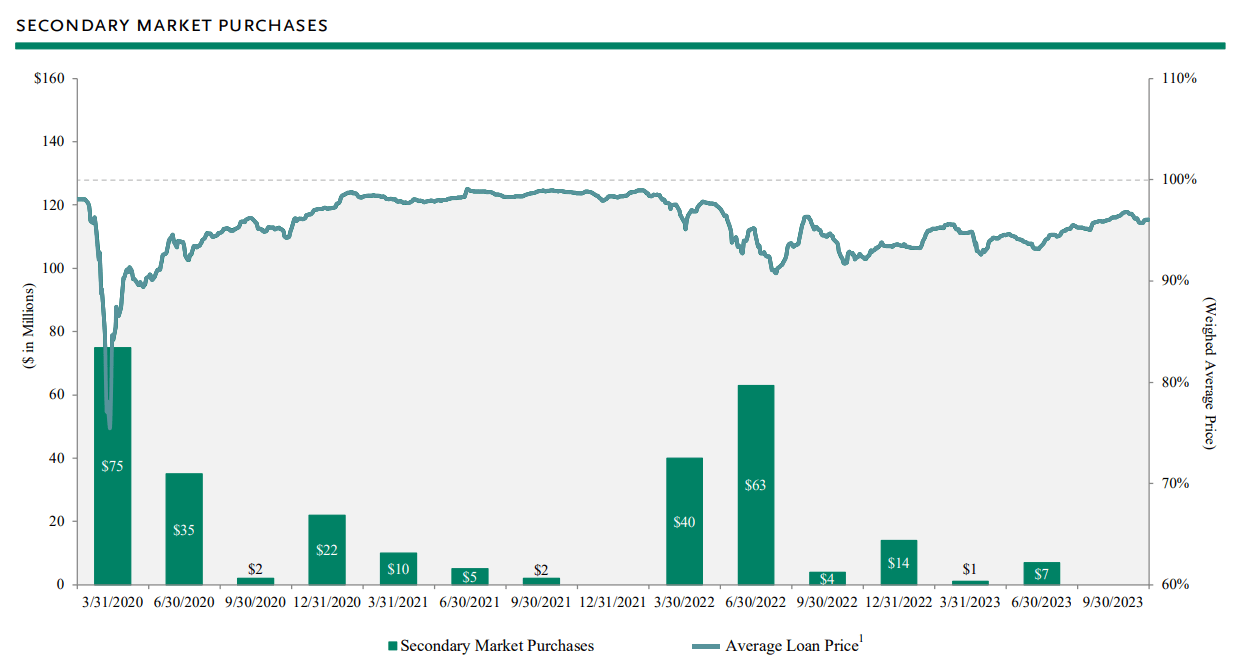

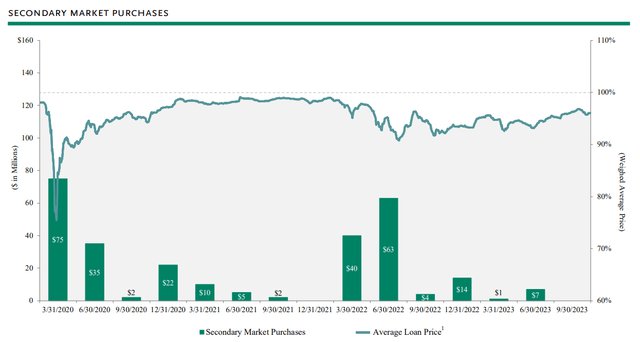

The primary focus of Oaktree Specialty Lending is private debt, but the investment company also invests in public debt which I consider to be an attractive feature of the BDC. OCSL obviously combines a disciplined credit investment approach in private markets with a more opportunistic, market-driven approach in secondary markets… the result is that the firm has often purchased deeply discounted debt investments during turbulent market periods, such as during the pandemic in 2020.

Oaktree Specialty Lending

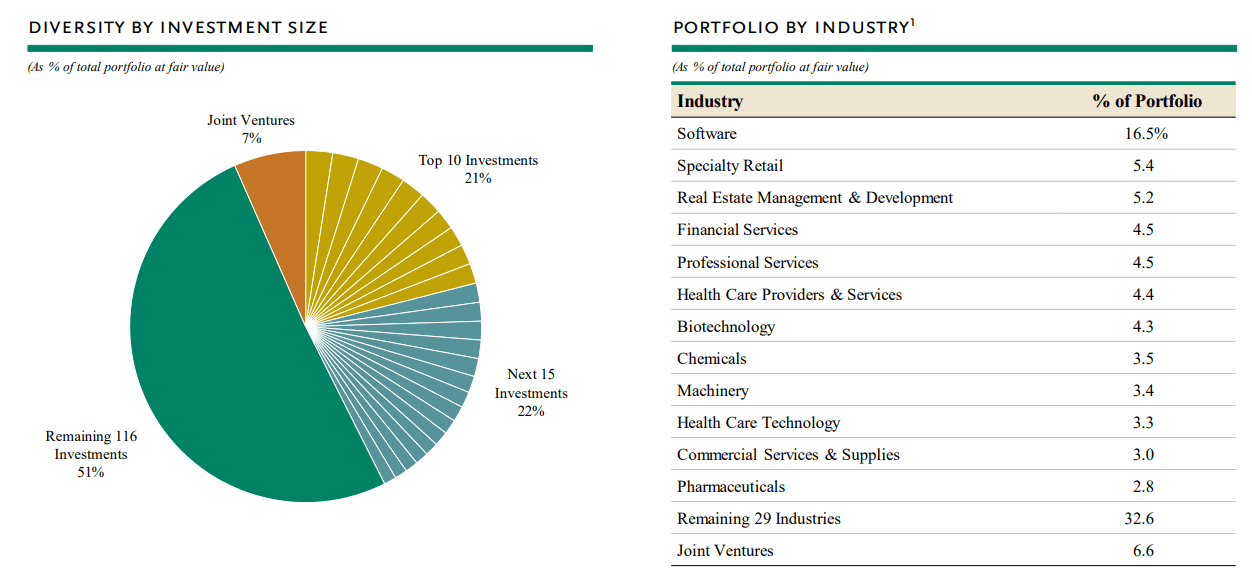

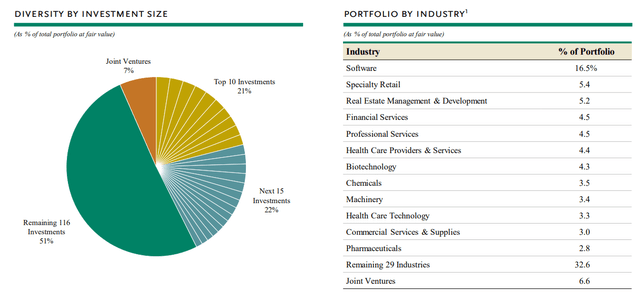

Oaktree Specialty Lending is broadly diversified, especially across sectors that are widely viewed as recession-resistant, such as Software, Professional Services, Health Care and Pharmaceuticals, to name just a few. The firm’s top ten investments accounted for only 21% of investment assets in the September quarter.

Oaktree Specialty Lending

Turning to NII and dividend coverage.

A BDC’s dividend coverage is a measure to gauge dividend safety and can be calculated by focusing attention on a company’s GAAP net investment income. Oaktree Specialty Lending’s quarterly distribution of $0.55 per-share has been well-supported since the BDC started to settle for this rate in Q1’23: the dividend coverage ratio in the first nine months of the year was 114%. The dividend coverage was good enough for Oaktree Specialty Lending to declare an extra (special) dividend of $0.07 per-share that will be paid in December.

Oaktree Specialty Lending

Liquidity

The third thing that I like about Oaktree Specialty Lending and which ties back to the first point of making opportunistic debt purchases in secondary markets is that the BDC has considerable liquidity that can be deployed during a market crash or a deep recession… which is usually when debt investment opportunities are abundant and especially lucrative: the BDC had about $1.0B in liquidity at the end of the September quarter which translates into considerable buying power (and a potential competitive advantage) during times when debt is priced cheaply.

Oaktree Specialty Lending

I am happy to pay a premium for OCSL

I am not chiefly a BDC or even high-yield investor, but Oaktree Specialty Lending is a well-run BDC that has achieved significant success by transforming the investment portfolio and concentrating it in higher-quality debt investments.

The growth trend in NAV is positive and it shows that the management takeover by Oaktree has been a success for investors: since the end of FY 2017, OCSL has seen 13% net asset value per-share growth which comes in addition to a growing contribution and the occasional special dividend.

Oaktree Specialty Lending

The net asset value is a well-accepted benchmark for a BDC’s fair value, and shares of Oaktree Specialty Lending currently trade slightly above net asset value (+2.3%) and about 12% above the 5-year average P/B ratio. Based on net asset value, OCSL is neither over- or under-valued, but based on the 5-year average P/B ratio, Oaktree Specialty Lending’s shares appear to be slightly overvalued.

Risks with Oaktree Specialty Lending

Risks relate largely to the company’s ability to pay its dividend and grow its net asset value. Changing market winds with regard to interest rates and loan quality could hurt Oaktree Specialty Lending’s ability to fund its distribution, but given that the BDC had 114% coverage in the first nine months of the year, I believe these risks are low.

Final thoughts

There are three reasons why dividend investors should give Oaktree Specialty Lending a shot, in my opinion: 1) Oaktree’s takeover of OCSL has been good for shareholders as portfolio quality has drastically improved since 2017 due to a shift towards a first lien strategy, 2) Oaktree Specialty Lending has considerable liquidity to deploy during market turmoil and has a history of making opportunistic secondary market purchases, and 3) The dividend is well-supported by GAAP net investment income. Oaktree Specialty Lending is a high-quality, well-run BDC, and I happily pay a premium for OCSL’s 11% yield!